Stop Stressing About Money

The free expense splitter and budget tracker with bill reminders—for roommates, couples & friends. 92% report more financial confidence.

No awkward conversations • 50,000+ people managing money together

Where Did All That Money Go?

Missed bills. Forgotten subscriptions. Transactions you don't recognize. "Who paid for dinner last time?" Sound familiar?

Savida shows you everything—every transaction, every bill, every split—so money finally makes sense.

How it works

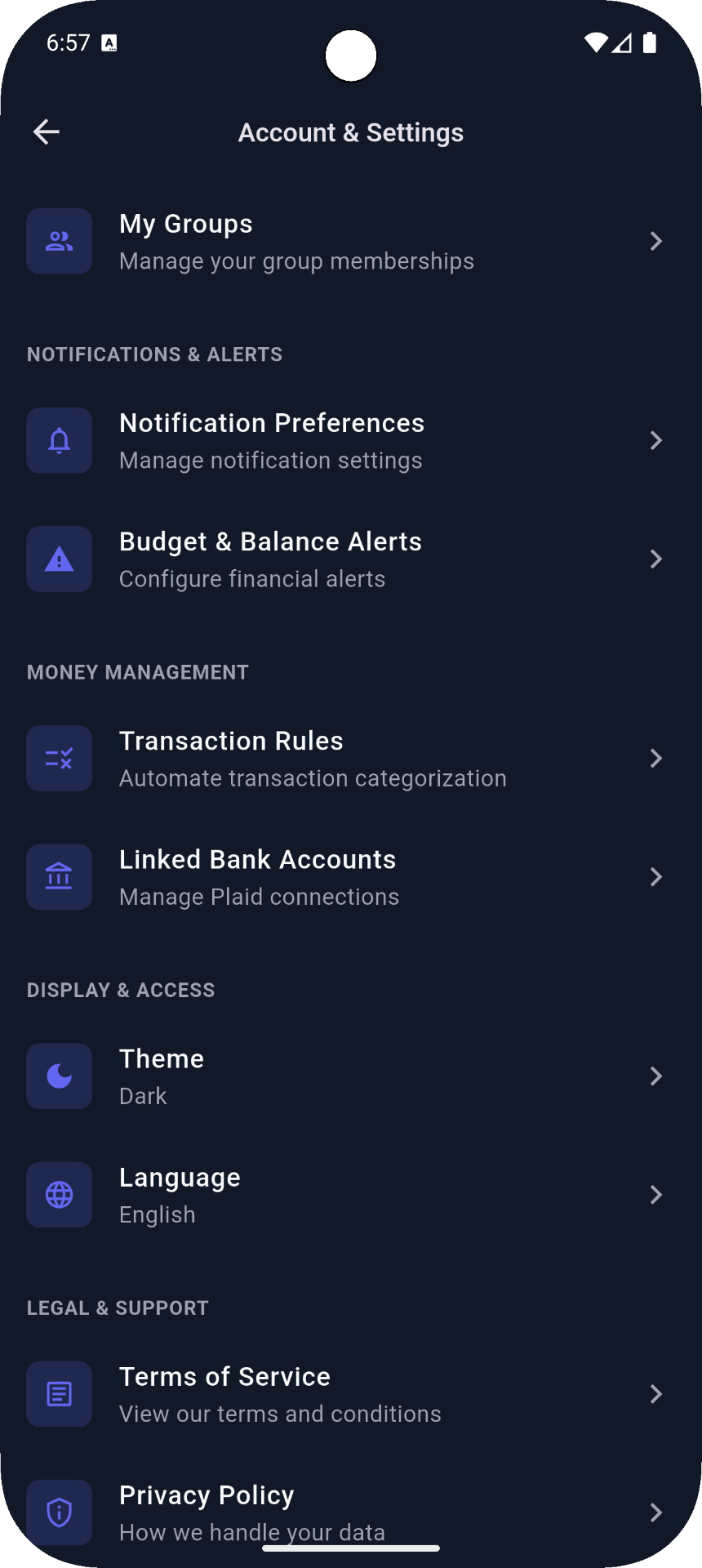

Link your bank

Connect through Plaid with bank-level 256-bit encryption. Read-only access—we never touch your money. Takes 2 minutes, then everything syncs automatically.

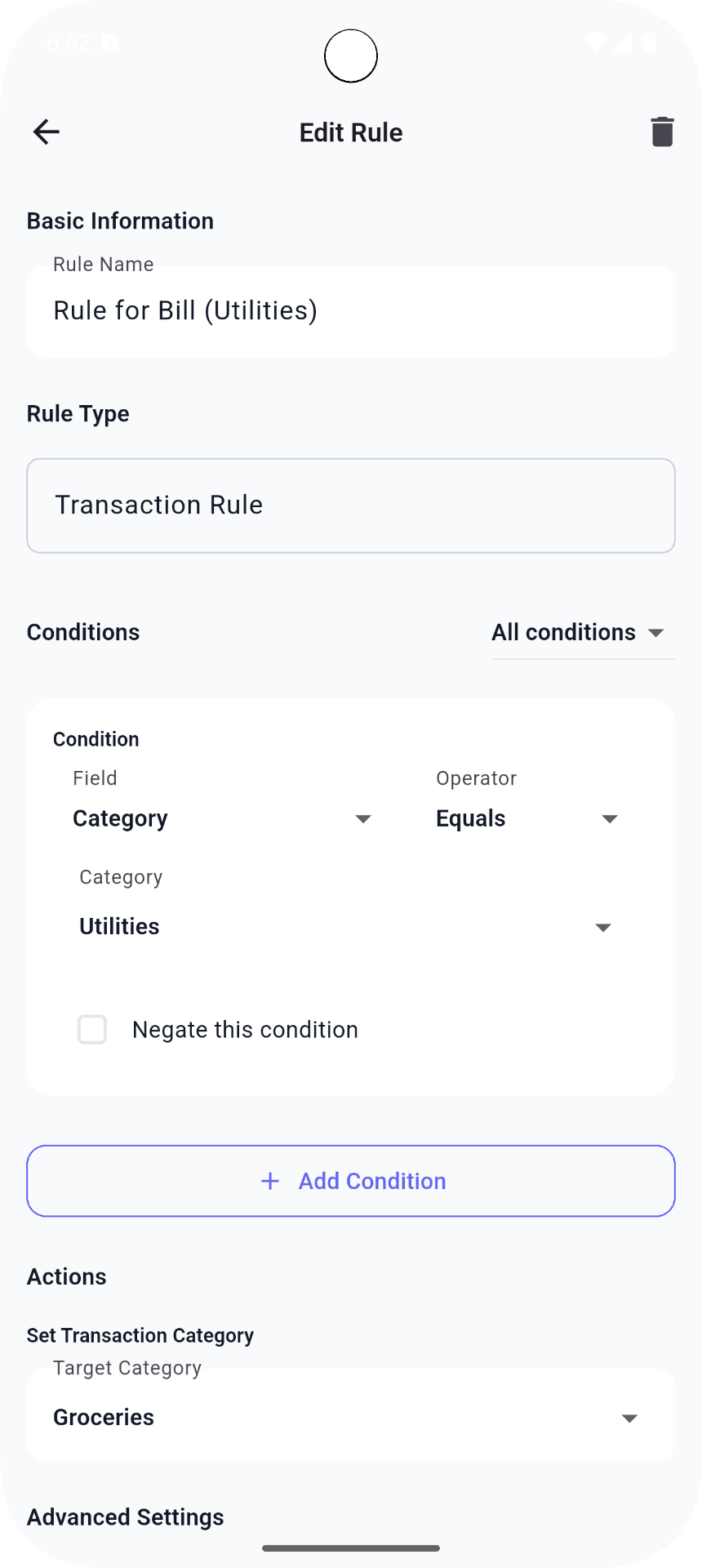

Create your rules

Tell Savida once how to handle things: split rent three ways, tag groceries, track shared Netflix. Done. It runs on autopilot from there.

See it all update live

Every payment, every expense, every goal—you'll see it move the second money changes hands. No more "wait, did you pay that?" texts.

Expense Splitting & Budget Tracking Made Simple

See Every Transaction

Bank sync pulls in your spending automatically. Categorized, searchable, and always up to date—no manual entry required.

Never Miss a Bill

Set up bill reminders for rent, utilities, subscriptions. Get notified before due dates so you're never caught off guard.

Split Bills Automatically

Roommate expenses, trips, couples—create groups and split bills automatically. The expense splitter that ends awkward "you owe me" conversations.

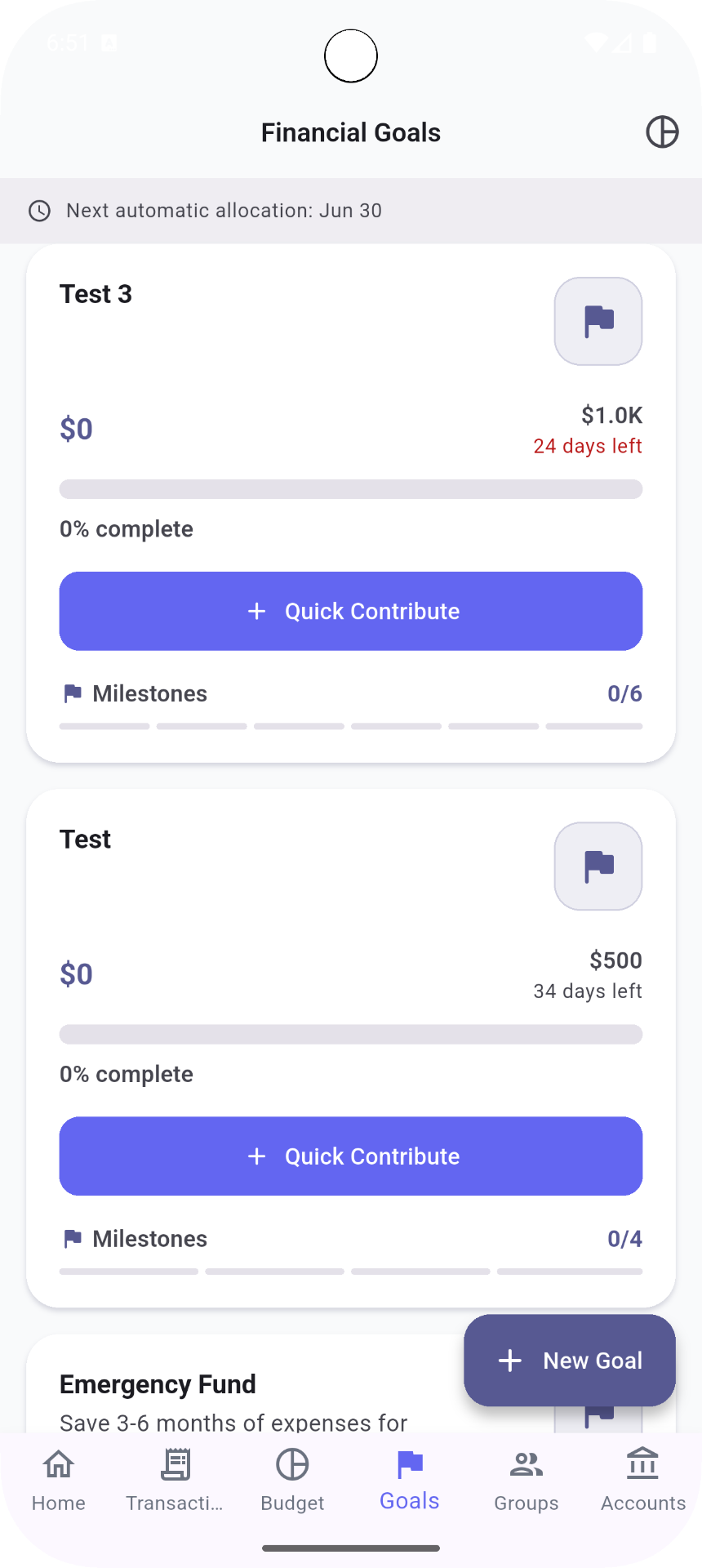

Watch Your Goals Grow

Set a savings target, link it to your account, and watch the progress bar fill. Every deposit feels like a win.

See Savida in Action

From automated transaction rules to financial goal tracking, see how Savida makes managing money effortless

Financial Goals

Track your progress toward financial milestones with visual goal tracking

Smart Rules

Set up automated rules to categorize transactions and streamline your workflow

Account Settings

Manage groups, notifications, and connected accounts all in one place

What Early Users Are Saying

"Honestly didn't think I needed another app, but this actually replaced like 3 things I was using. My roommate and I can finally see who owes what without the awkward texts.

"My boyfriend is terrible at Venmo-ing me back. Now he can't say he forgot because it's all right there. Game changer lol

"Was skeptical about linking my bank but the Plaid thing is legit. Saves me so much time not having to manually add everything.

"We used to have this massive spreadsheet for our vacation house. Took like 2 hours to update. This does it automatically.

"The goal tracking part is what got me. I can actually see our house fund growing instead of just hoping we're saving enough.

Resources & Guides

Learn how to manage your money better with our comprehensive guides and app comparisons.

Best Budgeting Apps 2026

Compare the top 10 budgeting apps to find your perfect money manager.

NewBest Expense Tracker Apps

Track every dollar with these powerful expense tracking tools.

TrendingMoney Saving Tips

Practical strategies to save more money every month.

GuideHow to Create a Monthly Budget

Step-by-step guide to building a budget that actually works.

See How Savida Compares

Find out why users are switching from other apps to Savida

The core app costs $0. Forever.

No trial that expires. No "basic" tier with annoying limits. Just the full app, free. Premium's there if you want it.

What's free forever?

- Unlimited groups, members, and transactions

- Manual expense tracking and split management

- Real-time goal progress and savings tracking

- Upgrade anytime for AI coach & automated bank sync via Plaid

FAQ

Is Plaid safe?

Yes—banks use the same encrypted connection.

What's free vs. premium?

Free tier includes core expense tracking. Premium ($9.99/mo or $79.99/yr) adds AI coach, automated bank sync, and advanced automation.

Savida

Savida